√完了しました! yield to maturity financial calculator ba ii plus 159937-How to calculate yield to maturity ba ii plus

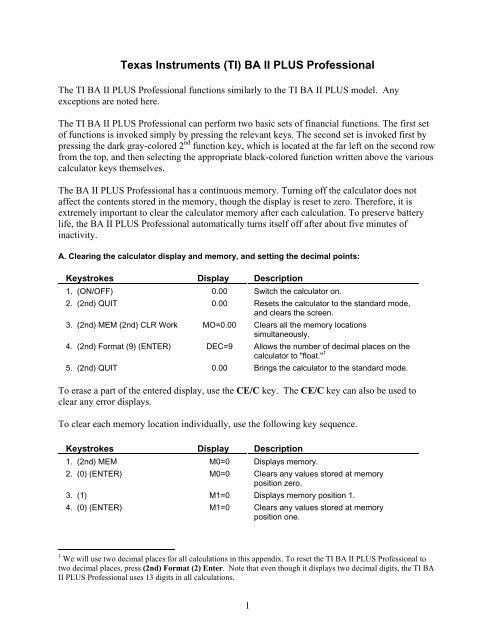

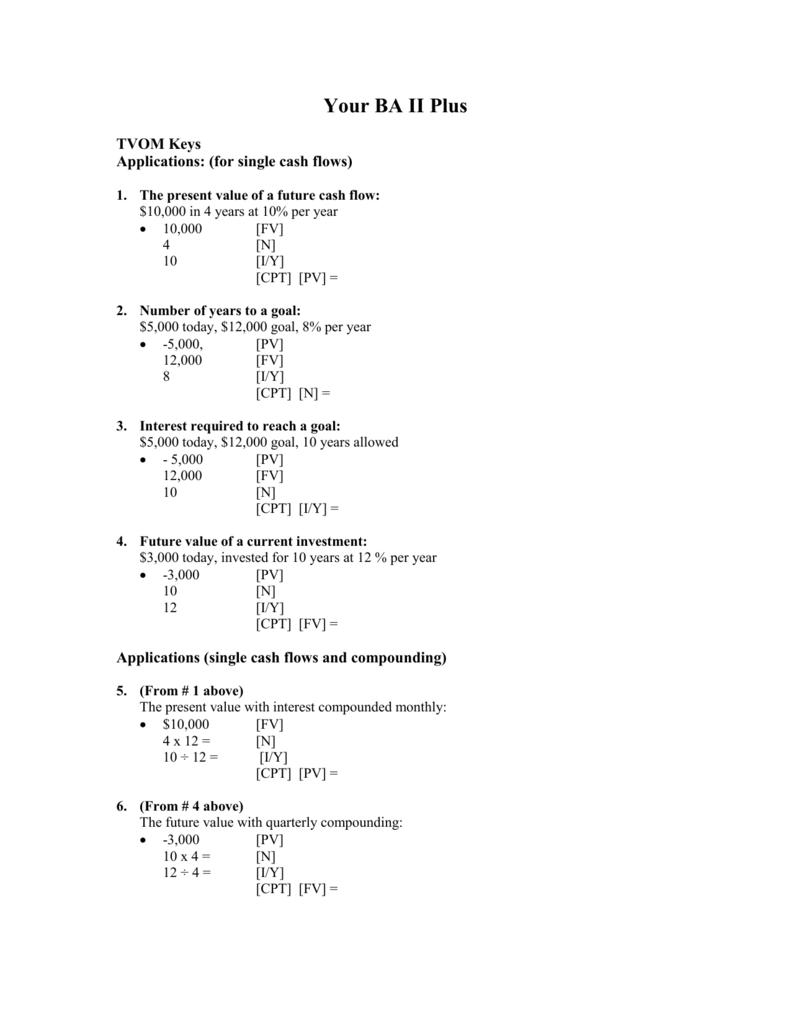

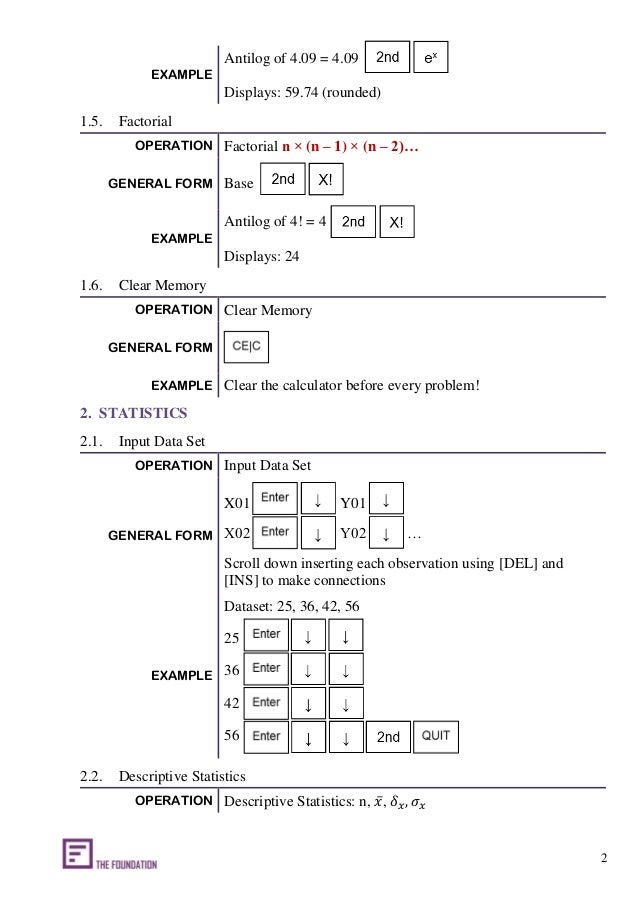

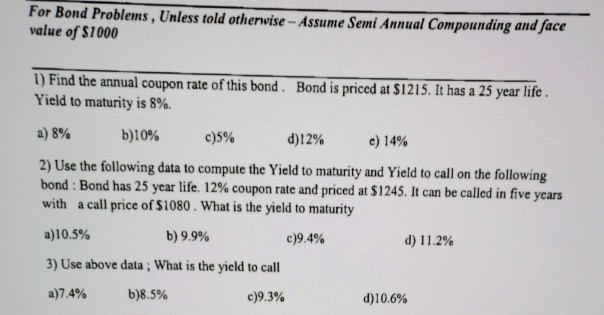

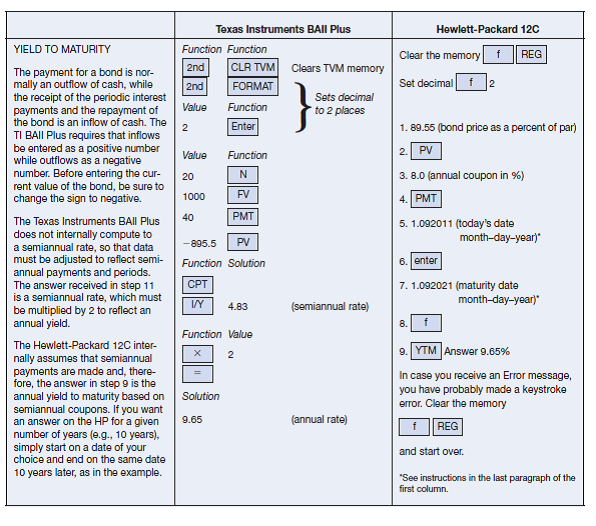

Financial Management for Engineers Fall Calculating yield (Bond) using BA II Plus Calculator 2 nd Bond 2 nd Clr work Enter enters settlement date 7 Enter enters annual coupon rate 12 3197 Enter enters redemption date 100 Enter enters face value of Bond 360 Enter enters no of days in one year 2/Y Enter enters 2 coupon payments per year shows Yld = 0 Shows Pri = 0 98Zero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bondTI BA II Plus Calculating Duration, Modified Duration, Price Impact for change in YTM by 50bp Posted By mz Exam Question At the end of May 13, one of your clients wants to invest 10'000 EUR in the bond market to diversify his fixed income portfolio

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

How to calculate yield to maturity ba ii plus

How to calculate yield to maturity ba ii plus-Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityChanging the Number of Decimals Displayed on the TI BA II Plus and HP 12c;

Texas Instruments Ti Ba Ii Plus Professional

BA II Plus™ financial calculator app The BA II Plus™ calculator is approved for use on the following professional exams Choose from two daycount methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call;Computing Realized Compound Yield With A Financial Calculator A Note Ronald L Moy, St John's University, USA To compute the RCY using the MIRR function in the TI BA II Plus Professional, the calculation requires The yield to maturity and internal rate of return represent just such a duality In this note, we showed that the conceptThe easytouse BA II Plus Financial Calculator solves timevalueofmoney calculations such as annuities, mortgages, leases, savings, and more Generates amortization schedules Performs cashflow analysis for up to 24 uneven cash flows with up to fourdigit frequencies

Four methods for calculating depreciation, book value, and remaining depreciable amount SLListbased onevariable and twovariable statistics with four regression optionsChoose from two daycount methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call;

The coupon payments are annual Use the 360day calendar format The example assumes a MDY date formatThe BA II is easy to understand and use It is consistently right in its calculations It is not a bad deal for the price of $3499 I borrowed a financial calculator from a friend who has an HP 10bII It was useless to me as I couldn't make any headway with itUsing TI BA II Plus Using a financial calculator to find YTM • Solving for I/YR, the YTM of this bond is 1091% This bond sells at a discount, because YTM > coupon rate INPUTS OUTPUT N I/YR PMT PV FV 10 1091 90 1000 7

Texas Instruments Ba Ii Plus Financial Calculator Ti Baii Ebay

Buy Texas Instruments Financial Calculator Ba Ii Plus Online Shop Stationery School Supplies On Carrefour Uae

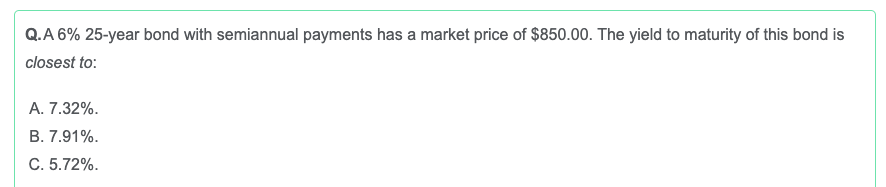

Source(s) calculate yield maturity tex instrum financial calculator https//trim/8iZm5Yield to Maturity Input 10 N, 4 PMT, 100 PV, and 100 FV Press CPT I/Y Press CPT I/Y Result is rate over six months, and so double number to obtain annual rate compounded semiannuallySwift & Co, expected dividend, PV, value in 2 or 5 yrs Finance Steps for TI BA II For Exxon bond price calculations Finance Steps for TI BA II Plus for Von Burns dividend yield, capital gain yield Financial Management keystrokes on a TI BA II to solve a YTM, YTC bond problem

Shopee Malaysia Free Shipping Across Malaysia

Ppt Mathematics Of Finance Powerpoint Presentation Free Download Id

How to Create a Simple Quadratic Formula Program on the TI and Voyage 0;If you bought this bond today, you would earn 1063% per year This yield to maturity calculator assumes that the bond is not called prior to maturity If the bond you're analyzing is callable, use our Yield to Call (YTC) Calculator to determine the bond's value To calculate a bond's yield to maturity, enter the face value (also known as "par value"), the coupon rate, the number of years to maturity, the frequency of payments, and the current price of the bondThe Yield to Maturity (YTM) is %, here's how to calculate n = 5 PV = ($1,050) PMT = $65 ($1,000 par x 65% annual coupon) FV = $1,000 i or YTM = or % Basically, both Texas Instruments BA II Plus financial calculators function the same way Perhaps the only difference is that the Texas Instruments BA II Plus

Ba Ii Plus Review

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

BA II PLUS calculator pdf manual download Sign In Upload Download Share Financial calculator (96 pages) Calculator Texas Instruments TI84 Plus Manual Book Ti ti84 plus user guide (697 pages) The yield to maturity takes into account the amount of premium or discount, if any, and the time value of the investmentTexas Instruments® BA II Plus Financial Calculator Item # Description Lets you choose from 2 daycount methods (actual/actual or 30/360) to calculate bond price or yield "to maturity" or "to call" Offers 4 methods for calculating depreciation, book value and remaining depreciable amountBA II Plus™ financial calculator Builtin functionality Solves timevalueofmoney calculations such as annuities, mortgages, leases, savings, and more Generates amortization schedules Performs cashflow analysis for up to 24 uneven cash flows with up to fourdigit frequencies;

Texas Instrument Ti Baii Plus Calculatornz S Blog

Http Faculty Babson Edu Goldstein Teaching 9e Financial Calculator Reference Pdf

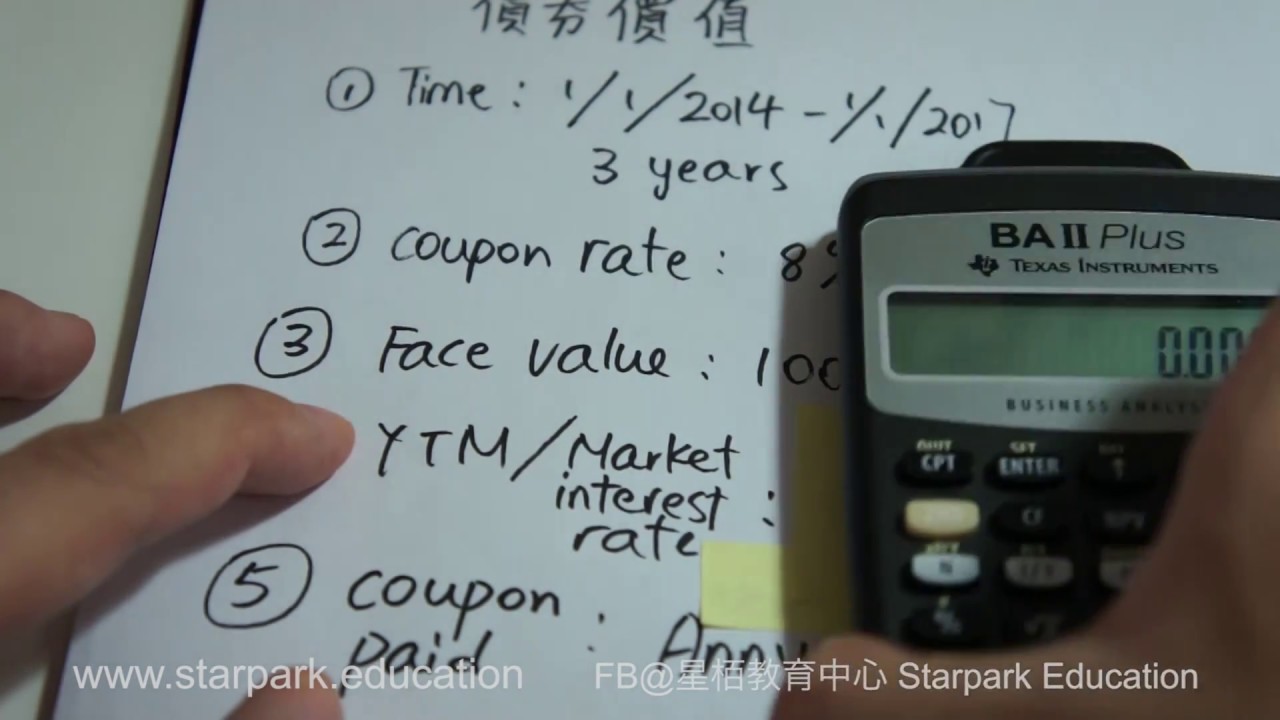

It has to be possible to calculate the Yield to Maturity on a discount bond with my Texas Instruments financial calculator (BA II plus), but I can't figure it out!?!YTM Calculator The YTM calculator has two parts, one is to calculate the current bond yield, and the other is to calculate yield to maturity Bond Yield Formula Following is the bond yield formula on how to calculate bond yield Current Bond Yield (CBY) = F*C/P, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond PriceWe will discuss each of these in turn below In the bond valuation tutorial, we used an example bond that we will use again here The bond has a face value of $1,000, a coupon rate of 8% per year paid semiannually, and three years to maturity We found that the current value of the bond is $

User Manual For Texas Instrument Ba Ii Plus Professional Peatix

Baii Plus Professional Tutorial Annuities Tvmcalcs Com

Our yield to call (YTC) calculator measures the annual return an investor would receive if a particular bond is held until its first call date For example, you buy a bond with a $1,000 face value and 8% coupon for $900 The bond pays interest twice a year and is callable in 5 years at 103% of faceSwift & Co, expected dividend, PV, value in 2 or 5 yrs Finance Steps for TI BA II For Exxon bond price calculations Finance Steps for TI BA II Plus for Von Burns dividend yield, capital gain yield Financial Management keystrokes on a TI BA II to solve a YTM, YTC bond problemThe easytouse BA II Plus Financial Calculator solves timevalueofmoney calculations such as annuities, mortgages, leases, savings, and more Generates amortization schedules Performs cashflow analysis for up to 24 uneven cash flows with up to fourdigit frequencies Offers depreciation schedules;

000 Instructions For Ti Ba Ii Plus

Ba Ii Plus Professional Financial Calculator For Cfa Garp Frm Exams

View and Download Texas Instruments BA II PLUS user manual online TI BA II PLUS User Guide BA II PLUS calculator pdf manual download Also for Ba ii plus pro ba ii plus professional financial calculator, Ba profit manager, Baiiplus ba ii plus financial calculatorTwo daycount methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call;Two daycount methods (actual or 30/360) to calculate bond price or yield to maturity or to call;

Ba Plus Pro Financial Calculator Apps On Google Play

New Texas Instruments Ba Ii Plus Financial Calculator Students Recourse Dha

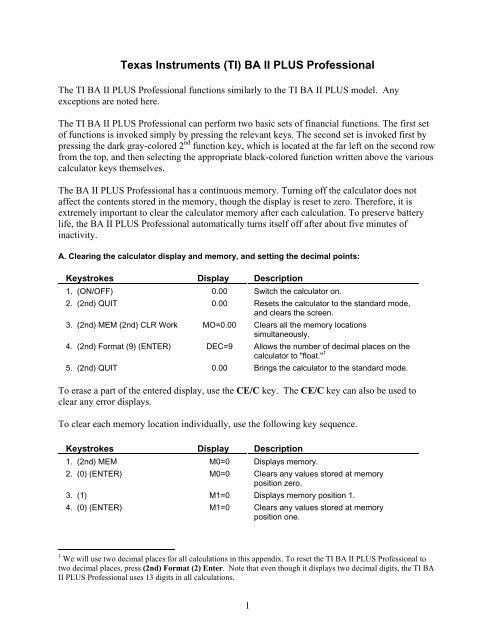

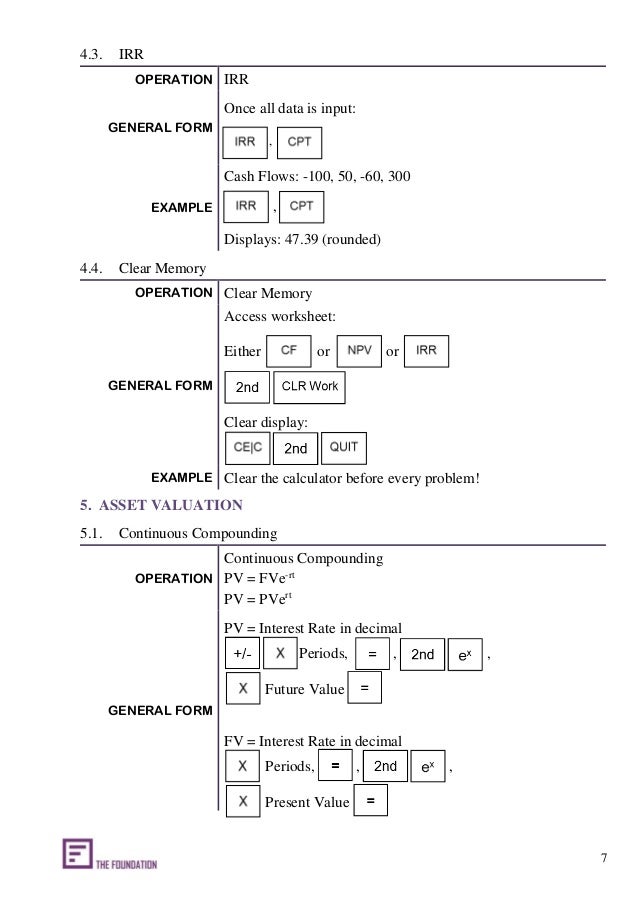

4 BA II PLUS™ Calculator Keys and 2nd Functions The primary function of each key is printed on the key For example, press $ to turn the calculator on or off Some keys provide a secondary function which is printed in yellow above the key When you press &, the character, abbreviation, or word printed above a key becomes active for theBA II Plus™ financial calculator app The BA II Plus™ calculator is approved for use on the following professional exams Choose from two daycount methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call;Business and Finance Math #4 Continuous Compounding on the TI BA II Plus & HP 12c;

Texas Instruments Ba Ii Plus Ti Ba Ii Bond Duration Bonds Finance

Instructions For Using Texas Instruments Ba Ii Plus Calculator Present Value Internal Rate Of Return

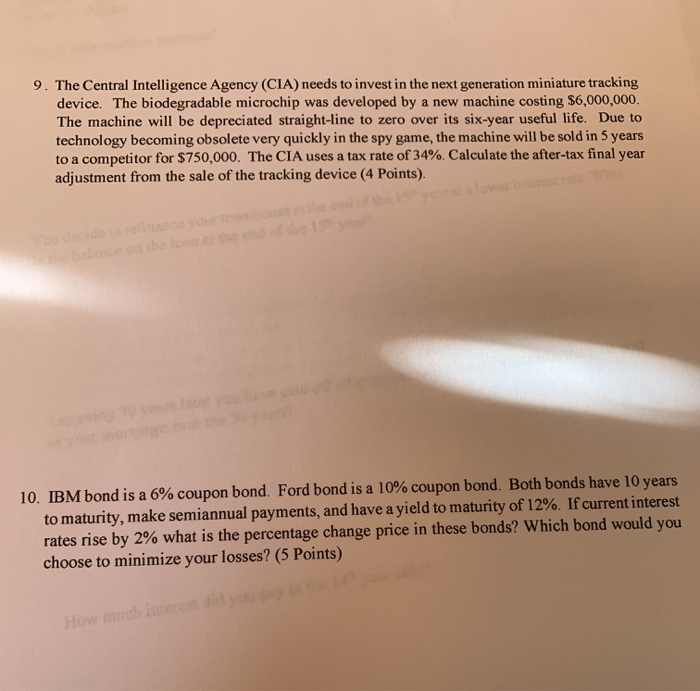

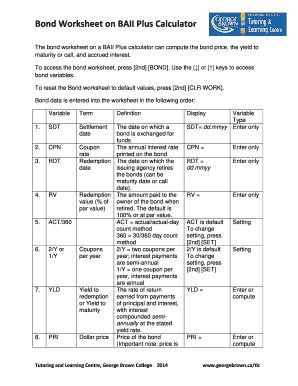

The bond worksheet on a BAII Plus calculator can compute the bond price, the yield to maturity or call, and accrued interest To access the bond worksheet, press 2nd BOND Use the ↓ or ↑ keys to access bond variables To reset the Bond worksheet to default values, press 2nd CLR WORKCalculator The yieldtomaturity can befound using thecalculator inthe bond worksheet asfollows SDT=(enter610), CPN=10, RDT= (enter), RV=100, ACT,2N, bypassYLD=,PRI=150 Review of Calculator Functions For The Texas Instruments BA II PlusThis lesson is part 2 of 4 in the course Using Texas Instruments BA II Calculator This video demonstrates the basic functionality of the Texas Instruments BA II Plus Financial Calculator It teaches you how to use the calculator to calculate the yield of a bond Given four inputs (price, term/maturity, coupon rate, and face/par value), we can use the calculator's I/Y to find the bond's yield (yield to maturity)

Amazon Com Texas Instruments Ba Ii Plus Advance Financial Calculator Home Decor Products Electronics

How To Calculate Discount Rate Using Financial Calculator Inspiring Video

This finance calculator app for Android devices is very similar as BA II Plus Professional Financial Calculator This finance calculator app has the same usage and operation sequences with BA II Plus Professional Financial Calculator, and it provide scientific calculation function and financial calculation such as timevalueofmoney, amortization schedule, cash flow, and so onFree, no Ads, not require any privileges This finance calculator app has the same usage and operation sequences with BA II Plus Professional Financial Calculator, and it provides scientific calculation function and financial calculation such as timevalueofmoney, amortization schedule, cash flow, and so on Support dates format and number separators format of USA and European, SupportFour methods for calculating depreciation, book value, and remaining depreciable amount SL

Www Studocu Com En Gb Document Aston University Investments Other Texas Instruments Baii Plus Calculator Instructions View

How To Fix Error 5 On Ba Ii Plus Calculators Appuals Com

The BA II Plus is a standard calculator with a variety of worksheet mode produced by Texas Instruments By far, the standard mode is mostly used to perform common math operations involving time value of money – applications such as mortgages or annuities (with equal and evenly spaced payments)The Yield to Maturity (YTM) is %, here's how to calculate n = 5 PV = ($1,050) PMT = $65 ($1,000 par x 65% annual coupon) FV = $1,000 i or YTM = or % Basically, both Texas Instruments BA II Plus financial calculators function the same way Perhaps the only difference is that the Texas Instruments BA II PlusChoose from two daycount methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call Four methods for calculating depreciation, book value, and remaining depreciable amount SL, SYD, DB, DB with SL crossover

Solved Please Show All Work With 4 Decimal Points On Calc Chegg Com

Texas Instruments Ti Ba Ii Plus Professional

Changing the Number of Decimals Displayed on the TI BA II Plus and HP 12c;How to calculate the horizon yield in the most efficient and fastest way using approved CFA® exam calculator?Four methods for calculating depreciation, book

Ba Ii Plus Financial Calc App Download Android Apk App Store

Ba Ii Plus Financial Calc On The App Store

Video provides stepbystep instructions for finding the yield of a corporate bond using the Texas Instruments BAII Plus CalculatorListbased onevariable and twovariable statistics with four regression options linear logarithmic exponential and power Math functions include trigonometric calculations natural logarithms and powersThe Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or losses The YTM is the internal rate of return of the bond, so it measures the expected compound average annual rate of return if the bond is purchased at the current market price and is held to maturity

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

Ba Financial Calculator Plus Free Download And Software Reviews Cnet Download

HP 10bII Financial Calculator Bond Calculations Keys and Functionality What is the yield to maturity on June 29, 13 for a 3% corporate bond that matures on December 4, 19 if it is selling for $?Using a BA II calculator Finance Steps on TI BA II Plus;View and Download Texas Instruments BA II PLUS user manual online TI BA II PLUS User Guide BA II PLUS calculator pdf manual download Also for Ba ii plus pro ba ii plus professional financial calculator, Ba profit manager, Baiiplus ba ii plus financial calculator

Ba Financial Calculator Pro Vicinno

Texas Instruments Ba Ii Plus Iibapl Tbl 1l1 Office Supplies Cdw Com

Calculator offers depreciation schedules;Calculating Basic Loan Interest with BA II Plus The monthly payment on my condo is $926 I originally took out a 30 year, $0,000 mortgage on the propertyHow to Create a Simple Quadratic Formula Program on the TI and Voyage 0;

Fillable Online Bond Worksheet On Baii Plus Calculator Fax Email Print Pdffiller

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

Yield to Maturity (Approx) = 876% This is an approximate yield on maturity, which shall be 876% Example #2 FANNIE MAE is one of the famous brands that are trading in the US market The government of the US now wants to issue year fixed semiannually paying bond for their projectOn this page is a bond yield calculator to calculate the current yield of a bond Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formulaYield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity

Texas Instruments Ba Ii Plus Baii Plus Financial Calculator Ba Ii Plus At Tigerdirect Com

Texas Instruments Ba Ii Plus Baii Plus Financial Calculator Baiiplus At Tigerdirect Com

BA II Plus™ financial calculator Builtin functionality Solves timevalueofmoney calculations such as annuities, mortgages, leases, savings, and more computes NPV and IRR;The bond worksheet on a BAII Plus calculator can compute the bond price, the yield to maturity or call, and accrued interest To access the bond worksheet, press 2nd BONDUse the ↓ or ↑ keys to access bond variablesUsing a BA II calculator Finance Steps on TI BA II Plus;

Ti Ba Ii Plus Emulator Mac Fasrcape

Ba Ii Plus Professional Calculator

Given four inputs (price, term/maturity, coupon rate, and face/par value), we can use the calculator's I/Y to find the bond's yield (yield to maturity) ForThe Texas Instruments BA II Plus financial calculator has builtin functions to solve business and financial problems related to time value of money, bond pricing, interest rates, breakeven analysis, depreciation, amortization and profitability coupon, redemption value, yield to maturity and number of days The calculator also computes aComputes NPV and IRR

Qgxvulrccbbhpm

Shopee Malaysia Free Shipping Across Malaysia

Look at the example below An investor purchased an optionfree bond with 6 years to maturity, the par value equal to USD 100 and both an annual coupon and a yield to maturity equal to 10%You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the results4 BA II PLUS™ Calculator Keys and 2nd Functions The primary function of each key is printed on the key For example, press $ to turn the calculator on or off Some keys provide a secondary function which is printed in yellow above the key When you press &, the character, abbreviation, or word printed above a key becomes active for the

Debt Security Yields Types Examples Financial Securities Class Study Com

Ba Ii Plus Rate Or Ytm On Bond Youtube

Sums and Sequences on the TI Plus and TI84 Plus;Business and Finance Math #4 Continuous Compounding on the TI BA II Plus & HP 12c;Sums and Sequences on the TI Plus and TI84 Plus;

Www Actexmadriver Com Assets Clientdocs Prod Preview Tiba35p Guidebook Pdf

Brief Tutorial For The Texas Instruments Baii Plus

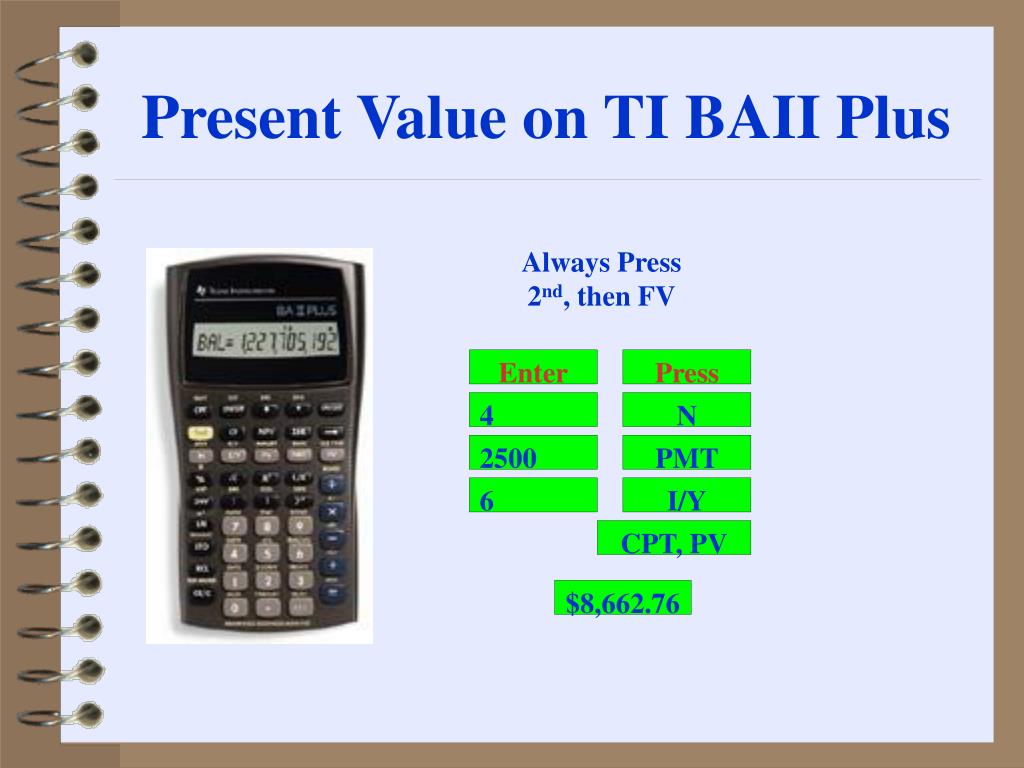

Advanced Calculator Functions TVM are the 5 keys on 3rd row N = number of periods I/Y = periodic interest rate PV = present value PMT = periodic payment FV = future value Calculator in END mode for PV (see Intro to BA video for all basic settings) Important clear memory through 2nd FV 2NN PMT PMT PMT FV = PV 1 IY 1 1 1III YYY

Shopee Malaysia Free Shipping Across Malaysia

Solved I Know The Correct Answer But I Would Like To Kno Chegg Com

Yapejinksrykwm

Texas Instruments Ba Ii Plus Financial Calculator Tabalonline Tabalonline

Solved I Need Help Solving Parts 1 2 And 3 On Either A T Chegg Com

000 Instructions For Ti Ba Ii Plus

Finding A Bond S Yield Using The Texas Instruments Ba Ii Plus Calculator Youtube

Texas Instruments Intros Baii Plus Calculator App For The Iphone Hothardware

Vandenberg Sdsu Edu Courses Fin323 Hp Ti Calculators Mcgraw Hill Pdf

Mortgage Calculations Using Ba Ii Plus Youtube

Financial Management I Review For Fin Ppt Download

Can You Please Show Me How To Do This With Ba Ii Plus Financial Calculator Ccan Homeworklib

Q Tbn And9gcqllhmdhbsaisafxxhpwzxau9wbqmxtkwbkali8wl Ensgsgrxw Usqp Cau

Ba Plus Pro Financial Calculator Apps On Google Play

New Texas Instruments Ba Ii Plus Financial Calculator Students Recourse Dha

Texas Instruments Professional Ba Ii Pro 10 Digit Financial Calculator At Staples

User Manual For Texas Instrument Ba Ii Plus Professional Peatix

Buy Texas Instruments Financial Calculator Ba Ii Plus Online Shop Stationery School Supplies On Carrefour Uae

Q Tbn And9gctp1y5f6ujqvayk Qvhnumlq3s4rb2atgp2covjbsrnbwdjispl Usqp Cau

Ba Ii Plus Financial Calculator Us And Canada

Ti Ba Ii Plus Calculator Ch

Ba Ii Plus Financial Calculator App Us And Canada

Texas Instruments Ba Ii Plus Adv Financial Calculator Ebay

Finding Bond Price And Ytm On A Financial Calculator Youtube

Ti Baii Plus Tutorial Annuities Tvmcalcs Com

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

6 1 July Outline Tvm Lab Interest Rates And Bond Valuation Ppt Download

Solved I Need The Steps For Calculating The Following Pro Chegg Com

Ba Ii Plus Financial Calc On The App Store

Ba Ii Plus Financial Business Accounting Economics Statistics Texas Instruments Ebay

Can You Please Help Me To Solve This Using A Financial Calculator Ba Ii Plus Question 6 0 1 Pts Courses Groups What Homeworklib

Ba Ii Plus Financial Cal C 1 7 Free Download

Texas Instruments Calculator Baii Plus Professional

Shopee Malaysia Free Shipping Across Malaysia

Finding The Yield To Call Of A Bond Using The Ba Ii Plus Youtube

Texas Instruments Ba Ii Plus Financial Calculator Office Depot

000 Instructions For Ti Ba Ii Plus

3v Learning Centre Cfa Exam In Nigeria Buy Cfa Calculator Texas Instruments Ba Ii Plus Professional Financial Calculator

Ba Ii Plus Tm Financial Calculator Online Game Hack And Cheat Gehack Com

Ba Financial Calculator Pro For Mac

Texas Instruments Ba Ii Plus Advance Financial Calculator Walmart Canada

Frm Using The Ti Ba Ii To Calculate Bond Price Or Yield Ytm Youtube

Ba Ii Plus Financial Calc On The App Store

Financial Management I Review Ppt Download

Texas Instruments Ba Ii Plus Adv Financial Calculator Ebay

Texas Instrument Financial Calculatornz S Blog

Solved Yield To Maturity On Both The Ti Baii Plus And Hp 12c Chegg Com

Finding Ytm By Using Financial Calculator Edit Youtube

Solved Eos 3 3 Johnson Motors Bonds Have 10 Years Remain Chegg Com

Texas Instruments Ba Ii Plus Professional Financial Calculator Iibapro Clm 1l1 D Walmart Com Walmart Com

Solved Determine The Yield To Maturity Ytm For Each Bon Chegg Com

Http College Cengage Com Business Garman Personal Fin 8e Students Study Appendixd Pdf

Using Texas Ba Ii Plus To Calculate Ytm Of A Bond Youtube

Frm Ti Ba Ii To Compute Bond Price Given Zero Spot Rate Curve Youtube

Texas Instruments Ba Ii Plus Professional Calculator Amazon Co Uk Office Products

Ba Financial Calculator Pro Vicinno

Http Faculty Babson Edu Goldstein Teaching 9e Financial Calculator Reference Pdf

Ba Ii Plus Financial Calculator Us And Canada

Ba Financial Calculator Plus 3 0 2 Free Download

Bond Valuation Chapter Ppt Download

Texas Instruments Ba Ii Financial Calculator University Of Toronto Bookstore

Texas Instruments Ba Ii Plus Professional Financial Calculator Iibapro Clm 1l1 D Walmart Com Walmart Com

Ba Ii Plus Cash Flows 1 Net Present Value Npv And Irr Calculations Youtube

Ti Ba Ii Plus Emulator Mac Fasrcape

コメント

コメントを投稿